Rising Connectivity Needs Drive Wireless Device Market Growth Across Industries Worldwide

The Wireless Device Market Growth trajectory within the Wireless Device Market is fueled by the expanding need for always-available connectivity across work, home, mobility, and industrial operations. Hybrid work has increased demand for mobile computing, hotspots, and Wi‑Fi upgrades, while digitization initiatives push enterprises to connect more assets, workers, and sensors. In consumer markets, replacement cycles are influenced by new radio capabilities (5G bands, Wi‑Fi 6E/7, Bluetooth LE enhancements) and by the expanding ecosystem of connected accessories. In enterprise markets, growth comes from fleet deployments—scanners, tablets, rugged phones, and wearables—linked to warehouse automation, last-mile delivery, and field service optimization. Healthcare adoption continues as wireless devices support secure messaging, bedside mobility, telemetry, and location services. Education and public sector upgrades also contribute through device modernization and improved campus networks. Importantly, growth is not only about unit volumes; it is also about the value of higher-tier devices that include advanced radios, security chips, and management capabilities. As connectivity becomes mission-critical, organizations invest in devices that reduce downtime and support predictable performance, accelerating spending on quality, manageability, and lifecycle support.

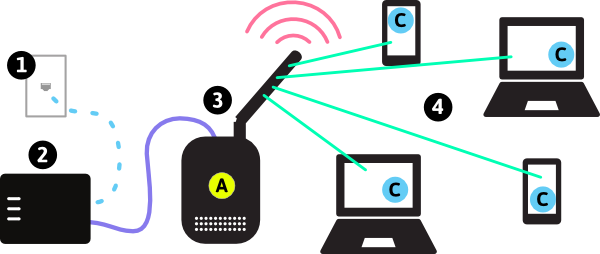

Network evolution is a primary growth catalyst. As 5G coverage improves and private cellular deployments expand, more organizations adopt wireless devices for roles previously served by fixed terminals. Private 5G and LTE networks enable predictable performance for factories, ports, and campuses, creating demand for compatible endpoints and modules. Wi‑Fi continues to grow as well, especially with Wi‑Fi 6/6E improving dense-environment performance and Wi‑Fi 7 promising higher throughput and lower latency. Bluetooth innovation expands wearable and accessory markets, while UWB adoption enables precise indoor positioning for access control, asset tracking, and smart home interactions. LPWAN technologies support long-battery sensors for utilities, agriculture, and environmental monitoring. Each network option creates device refresh pressure because older endpoints cannot exploit new capabilities or may lack security features required by modern policies. As multi-radio devices become standard, vendors that can optimize coexistence—reducing interference between Wi‑Fi, Bluetooth, and cellular—gain a performance advantage, which translates into higher adoption and repeat purchasing.

Enterprise procurement behavior is another growth driver. Companies increasingly standardize device portfolios by role and environment, selecting a small set of approved models with defined accessories, warranties, and support processes. This reduces operational complexity and increases purchasing scale. Subscription and device-as-a-service models are growing, bundling hardware, support, replacement, and sometimes connectivity into predictable monthly costs. These models can accelerate adoption because they lower upfront capex and simplify budgeting. Additionally, regulatory and security requirements can force upgrades: stronger encryption standards, OS support expectations, and compliance mandates encourage replacement of older devices. The rise of zero trust architectures strengthens demand for devices that support modern identity, certificate-based authentication, and secure boot. Meanwhile, analytics-driven asset management encourages upgrades to devices that report richer telemetry for performance and security monitoring. These enterprise dynamics often produce steadier, programmatic growth than consumer replacement cycles.

Constraints still influence the pace and shape of growth. Supply chain volatility can delay launches and raise costs, especially for RF components and advanced chipsets. Global economic conditions affect consumer upgrades, while enterprises may extend device lifecycles unless there is a clear productivity or security justification. Compatibility and fragmentation can slow adoption when apps, peripherals, or regional bands vary widely. However, the direction remains positive because wireless connectivity is becoming foundational infrastructure for digital business. Growth leaders will be vendors that deliver reliable multi-radio performance, long-term software support, secure provisioning, and strong ecosystem compatibility—helping buyers scale wireless device fleets with fewer operational surprises and lower lifetime cost.

Top Trending Reports:

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness